Should I buy Jewellery, Bars or Coins for Investment?

Should I buy Jewellery, Bars or Coins for Investment?

This is a subjective question as there isn’t a right or wrong answer per se. To get it out of the way, we do not recommend jewellery as a form of investment because it often comes with a lot of ‘hidden’ cost such as workmanship cost, designing cost and etc.

Another reason as to why we do not recommend jewellery as a form of investment is because there are times where the purity of the jewellery can be at question. For an example, you can buy a 916 (91.6% purity) gold jewellery from a reputable goldsmith but if you were to bring that exact same jewellery to another goldsmith, they might question or even doubt whether the purity is 91.6% as there is no ‘clear cut’ way of identifying other than the use of acids and hallmarks which are not very accurate.

On the other hand, when it comes to bullion (bars and coins), they are easily identifiable as the purity, weight and minter is stated on the bar or coin. If they are not, a simple Google search will yield all the information you need to know which are also published on the respective refineries official website.

So, the age old question remains, bar or coins?

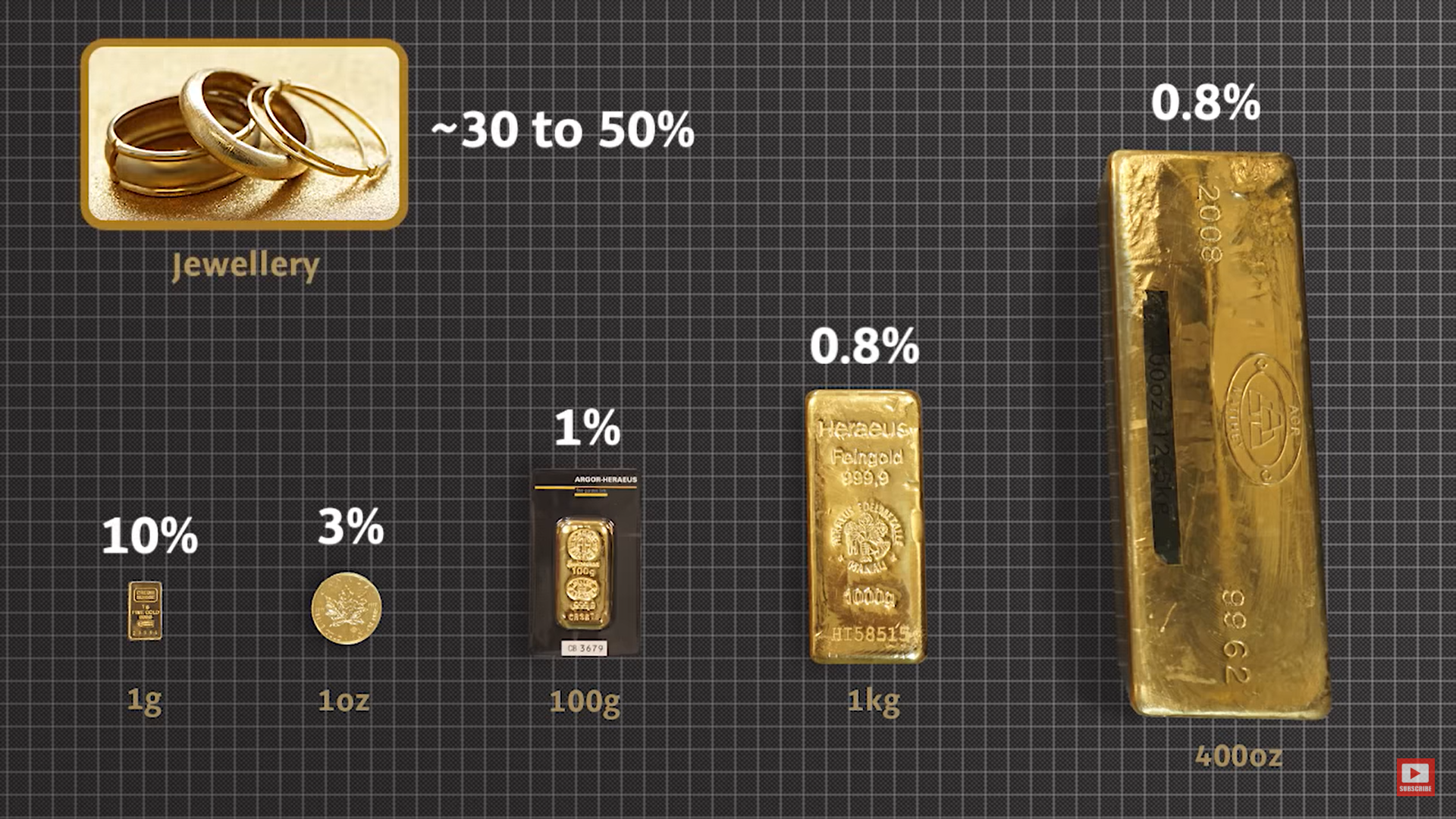

Bars are perfect for investors which want more ‘bang for buck’ or value for money. Why? Bars often cost less to produce and in return reflects a lower selling price. Bars might be ‘boring’ to look at but it serves its purpose perfectly whereby if you are looking for the most cost efficient way to purchase precious metals, bars are your answer.

As for coins, they are ‘a work of art’ to some, as it often depicts beautiful designs such as the Canadian Maple Leaf, Austrian Philharmonics and the American eagle, but beauty often comes at a price. More often than not, coins have a higher selling price than bars because they cost more to produce.

A lot of effort goes into designing the die (mould) needed to produce the design on which we see on a coin. Coins and Rounds are also often mixed up as the same thing but as a matter of fact, they are not. Coins by definition must have a legal tender and made by a sovereign mint as these coins are considered to be part of the monetary supply. Rounds on the other hand are ‘coins’ which does not have a legal tender value and are often made by private mints.

So to answer this question, if you are an investor who prioritizes value for your money, stick to bars. If you prefer your bullion to be of legal tender, made by a sovereign mint and have a beautiful design, coins are your answer.

|

| Example of Premium Charged for Gold by LBMA Refineries |

|

| Example of Premium Charged for Silver by LBMA Refineries |