Silver Bullion sells cobalt parcels, in the form of 250 kg (551 lb) industrial-sized drums.

These cobalt parcels are uniquely identified physical property, tracked in our parcel ownership list, audited by Ernst & Young LLP and Bureau Veritas, fully insured against loss, guaranteed to be genuine, and stored in Singapore.

Being your property, these parcels can be sold 24/7, used as collateral for low interest peer-to-peer loans, or taken delivery of.

We utilize the last LME cash offer settlement price set daily by the London Metal Exchange (LME) as the reference cobalt price.

Cobalt storage fees are fixed at 190.69 SGD (190.69 USD) per 250 kg parcel per year. In percentage terms, the storage fee:

- is 0.00% of the current cobalt price

- will be 0.00% if cobalt doubled in value

- will be 0.00% if cobalt tripled in value

Any unused storage will be refunded upon sellback or delivery.

Cobalt shortages are becoming public knowledge

Large car manufacturers, such as Volkswagen, have had problems securing the long-term cobalt supplies they need. News of cobalt shortages have caused other manufacturers to try and lock in physical supplies, causing a 350% price surge between 2016 and 2018.

This shortage is underlined by the extremely thin cobalt reserves held by the London Metal Exchange (LME) to back traded cobalt futures. As of early May 2018, this supply of cobalt is just 460 tons, roughly USD 40 million of physical backing. This makes it increasingly difficult to obtain this highly sought-after metal.

View some of the recent articles on cobalt:

Cobalt is essential for high-performance EV batteries

Cobalt is a key component used in the cathode of nearly all high-performance lithium-ion battery chemistries. Cobalt is used to stabilize nickel and extend the battery life in the NMC (nickel manganese cobalt) and NCA (nickel cobalt aluminum) chemistries. It is also the primary metal in LCO (lithium cobalt oxide) chemistries used for smartphones.

While cobalt can be used as a primary high energy density storage medium (LCO), the metal’s high cost is making such chemistries increasingly expensive.

As of early 2018, about half of the cobalt demand comes from the battery sector. Given the enormous upcoming battery demand from the electric vehicles (EV) sector, there will be physical cobalt shortages which are reflected in cobalt's steep price appreciation.

LME cobalt pricing and supplies

The London Metal Exchange (LME) sets cobalt prices once daily during London trading days. These are the industry reference prices we also utilize.

Although it is possible to acquire physical cobalt via the exchange, only eight suppliers participate in the system. These suppliers account for less than 20% of cobalt mined. Only around 400 tons (representing just 0.3%) of yearly production is available at the LME as of 2018.

While LME prices are widely used, very little cobalt is delivered through the exchange itself. Instead, miners typically commit to off-take contracts to sell future production over time, such as five tons per month for five years. Off-take contracts imply that most future cobalt mining supply has already been sold, greatly limiting availability for latecomers and exchanges.

Off-take contracts create an opaque supply system that is prone to disruption, should the miners involved be unable or unwilling to deliver (many of these miners are heavily dependent on the geopolitical environment in the Democratic Republic of Congo DRC). This is interesting for physical cobalt holders, as these holdings could become very valuable should cobalt dependent factories experience acute supply disruptions and are forced to buy physical to prevent factory shutdowns.

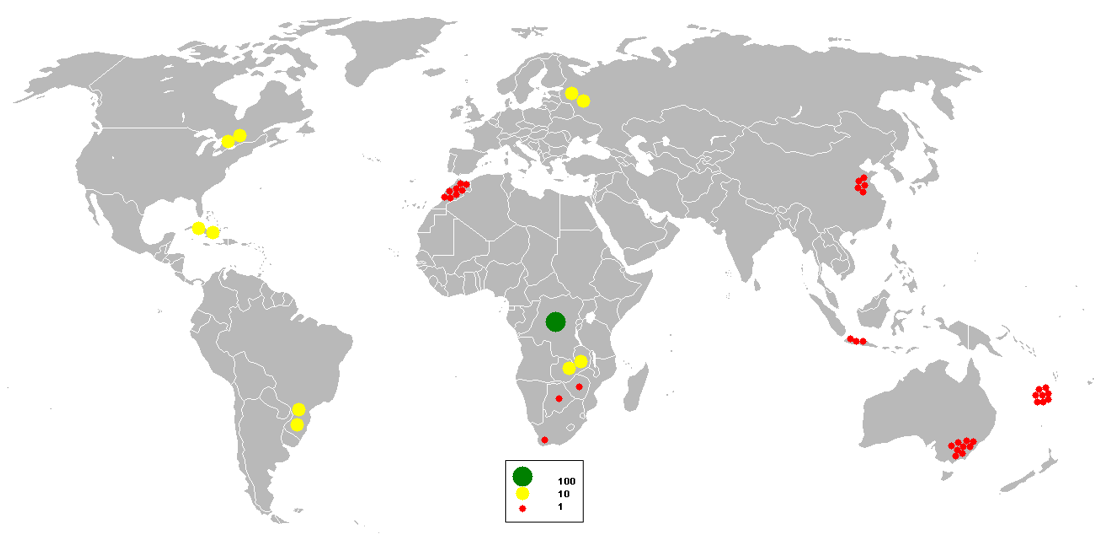

Cobalt production and sourcing

The top 5 cobalt producers (2016 numbers):

- Glencore, 27,400 tons. Mining in DRC; Swiss company

- China Molybdenum, 9,314 tons. Mining in DRC; Chinese company

- Fleurette Group, 7,595 tons. Mining in DRC; Israeli company; to be absorbed into Glencore

- Vale, 5,278 tons. Mining in Canada and New Caledonia; Brazilian company

- Gecamines, 4,167 tons. Mining in DRC; DRC state-controlled miner

Of the top five mining companies, four have extensive operations in the Democratic Republic of the Congo (DRC). The soil in the DRC is very cobalt-rich, allowing this country to supply over half of cobalt worldwide. Unfortunately, the DRC is also known for its citizens’ poverty and its governmental mismanagement, corruption and brutality.

While the DRC concentration takes center stage, cobalt is otherwise fairly spread out worldwide as it is mostly mined as a byproduct of nickel and other primary metals. Due to shipping routes, China, Australia, New Caledonia, Papua New Guinea and the Philippines are the most efficient sources of cobalt for Singapore.

Our available sources are from China, Australia and warrantable LME lots. We do not source any cobalt from the DRC nor from Glencore, Fleurette, China Molybdenum or Gecamines.

Purchase cobalt parcels

Physical cobalt is currently unavailable due to supply constraints.

Sell your cobalt parcels

You can sell back your cobalt parcels 24/7, and receive USD, SGD or Euro.

Cobalt as collateral

Obtain a loan in SGD/USD for up to 50% of your parcels’ value (or up to 62% for one month loan contracts) via Secured Peer-to-Peer Loans. The process is fast, easy and reliable.

Take delivery of your cobalt parcels

You can arrange to withdraw your cobalt parcels and have them shipped.

Please contact us for local and international shipping.