Frequently Asked Questions

- Our Products

-

- What is LBMA Good Delivery status and Why is It Important?

-

In 1750, the Bank of England set up the London Good Delivery List, which formally recognised those refineries that produced gold bars of a certain standard and could therefore be allowed to enter the London market. Today, this list is regarded as the only globally accepted accreditation for the bullion market, ensuring that the wholesale bullion bars traded in the market meet the standards and quality required for Good Delivery status. Today, the LBMA handles that responsibility for both gold and silver under the auspices of its Physical Committee, which has to be satisfied that the bars meet the stringent, globally accepted, requirements set by the Association.

Refiners of platinum and palladium have to similarly satisfy the Management Committee of the LPPM. The LBMA and LPPM Good Delivery accreditations have become the internationally accepted standards of product and refinery quality. Given the status that Good Delivery has attained, both the LBMA and the LPPM take very seriously the assessment for inclusion in their Good Delivery Lists. The ongoing review and maintenance of the Good Delivery Lists is one of the core functions of both organisations.

Gold and Silver

Only gold and silver bars that meet the LBMA’s Good Delivery standards are acceptable in settlement of a Loco London contract. The LBMA benchmarks and regulates the acceptable requirements for large gold and silver bars through its continuously updated publication of the London Good Delivery Lists. These standards, recognised throughout the world, ensure that accredited refiners continue to maintain the high standards necessary for listing. The Lists can be accessed on the LBMA’s website. The Lists are also used by many precious metals exchanges around the world to define in whole, or in part, the refiners whose bars are accepted in their own markets. Exchanges utilising the LBMA’s work in this field include ICE, Borsa Istanbul, CME Group and TOCOM, as well as the Singapore Bullion Market Association, Shanghai Gold Exchange and Dubai Multi Commodities Centre.

Requirements for Listing

The requirements for listing involve a stringent set of criteria, which include a minimum level of production and tangible net worth, with a rigorous technical assessment to review casting, refining and assaying abilities. To ensure that the high standards are maintained, Accredited Good Delivery refiners are subject to on-going testing under the LBMA’s Proactive Monitoring Programme. Refiners that no longer meet the minimum standards, or those that decide to stop producing Good Delivery bars, are transferred to the Former Lists for Gold and Silver.

LBMA Physical Committee

The Physical Committee is made up of industry experts from the physical bullion market. It is responsible for monitoring, developing and protecting the Good Delivery Lists and works closely with sub-groups such as the LBMA Referees and the LBMA’s Vault Managers Group. It also ensures that standards are maintained, with emphasis on continuous improvement and transparency of the market. The Committee meets approximately every month throughout the year.

LBMA sets the stringent criteria that enable the global trade in gold and silver bars. It is the de facto standard trusted around the world.

- Which bullion coins are tax free?

-

Under the current Sales and Service Tax (SST) system, only Silver and Platinum coins/rounds are taxable while Gold coins/rounds are not. The total amount of tax which is incurred is 15.5% (10% SST and 5% Import Duties). Prices in which you see on the website are nett meaning that will be the final price which you will have to pay (no hidden or additional charges).

- Which bullion bars are tax free?

-

Under the current Sales and Service Tax (SST) system, Gold, Silver and Platinum bars are tax free.

- Can I place a phone or mail order?

-

We have committed substantial resources in building a web-based service to facilitate the most efficient trading platform to buy silver, gold and platinum bullion in Malaysia.

We can be contacted by phone for clarifications and support but all orders need to be locked in (submitted) through our website. Phone orders are substantially more expensive to support and are not yet an option with our current service structure.

Mail orders are not accepted due to the constantly fluctuating market prices and the local post office is not delivering bullion. At such, please order from our website and we will process your orders as we receive them.

See the section on Price Confirmations and Binding Agreement on how to purchase bullion from us.

- Payment

-

- What are the forms of payments do you accept?

-

We accept cash, domestic bank transfer, international wire transfer and cheque.

For International wire transfer, please ensure both sending and receiving SWIFT charges are paid for.

Please take note that, for cheque payments, bullion can be taken possession of or delivered seven (7) working days after the cheque clears with the bank.

- How will I know if my payment was received?

-

We will send an e-mail confirmation once we receive your payment.

- How quickly do I have to make payment?

-

As per our order policy, full payment must be received within two (2) business days of placing your order. If payment is not received within this timeframe, Silver Bullion Sdn Bhd reserves the right to cancel the order and impose applicable cancellation and market loss fees. Alternatively, we may, at our sole discretion, choose to accept the late payment or issue a revised quote based on prevailing market prices at the time of receipt. Please refer to our cancellation and late payment charges. here.

- Can I buy using a credit card ?

-

Yes, credit card payments will be accepted for local orders (local pick-up). A 3.00% credit card transaction fee applies for local bank issued cards and 4% for foreign banks, which is only available for payments of up to RM10,000 (RM10,000 per day).

Please only use a credit card that is in your name.

Credit card orders over RM 5000 may need extra manual review by our team due to the increased risk of fraud. We could also ask you to show the credit card used to pay for the order as an extra security measure. Any credit card orders that are deemed questionable or to create a significant risk to Silver Bullion may be rejected at our discretion.

- Can I cancel my order?

-

Once you submit an Order or a Sellback, all prices are locked-in, and a binding legal agreement between you and Silver Bullion is created to purchase and/or sell precious metals or other products. It is not our intention to enter into buying and/or selling transactions, accepting the costs and risks involved (e.g., market price fluctuations, heding costs) only to have them canceled. However, we realize rare situations happen where orders need to be canceled. In such cases, we may allow, at our sole discretion, to dissolve the binding legal agreement to buy and/or sell with you. All cancellations are subject to our Market Loss Policy plus a Cancellation Fee of RM 45.00 of the Order or Sellback total.

Any cancellation requests must be filed via telephone during normal business hours. Silver Bullion will evaluate any request to cancel an Order or Sellback on a case-by-case basis, and only under extraordinary circumstances will a cancellation request be approved.

- Pricing

-

- What currency can we make our purchases in?

-

Your order can be placed in multiple major currencies by clicking on the icon on the top left to change to your preferred currency.

- What is the spot price of silver? Why do our prices keep changing every 5 to 10 minutes?

-

The silver spot price “is the instantaneous price someone is willing to pay in cash for a unit of silver”. Usually the unit refers to one troy ounce (31.1 grams) and it is normally priced in US dollars.

It is determined in a few major worldwide commodity exchanges around the world during local business hours. Major exchanges are in London, New York and Hong Kong. As exchanges worldwide open, we update our selling prices in short intervals to follow market prices. As bullion margins are very low compared to traditional jewelry outlets we need to keep prices as updated as possible.

Furthermore as we operate in Malaysia with the functional currency being Malaysian Ringgit, we price our items in Malaysian Ringgit and we convert US dollar silver spot prices into Malaysian Ringgit prices based on the current exchange rate. Therefore our prices will change when either the spot prices change or the USD/MYR forex rate changes.

Please note, for large orders, we can transact based on the LBMA morning price for a given date.

- Why has the spot price of silver not been updated for days (such as during the weekend)?

-

When silver market exchanges such as Comex are closed, the price of silver is not updated as no trades are executed. Exchanges will be closed on from Friday afternoon onward (through the weekend) until Monday morning, and during certain holidays.

- Why are you selling silver at a higher prices per ounce than the spot price (for example, spot price is MYR 60, why are you selling at MYR 74)?

-

Physical bullion always has a premium covers over spot price to cover:

• Manufacturing and assay costs to strike and certify bullion coins or bars

• Insured transport and storage costs

• Possible taxes

• Capital costs which are very high as the industry is strictly based on prepayments

None of these costs apply to pure paper silver derivatives as they represent a price exposure to the spot price with no practical means to convert to physical bullion. Hence physical bullion and paper derivatives of silver are two very different products as the former can be quickly issued in nearly unlimited amounts and is settled in currency whereas the later represents a finite physical commodity.

The exact ratio between physical positions and paper positions is not known exactly and it can be defined in various ways. The practice to lease silver out, which would normally be counted as reserves, further complicates obtaining an accurate number. However based on the Comex futures exchange, this ratio is around 5%. Studies by the CPM Group assume a 1% ratio when other forms of silver derivatives are included. It is therefore a safe assumption that there are somewhere between 10 and 100 paper derivative claims for every ounce of physical silver.

In this context the simplicity and lack of counterparty risk of fully owning physical bullion over the long term lends itself very well as a protection against inflation, a currency crisis and is likely to appreciate as confidence wanes in financial institutions and complex derivatives. However it’s higher transaction costs make it ill suited for frequent trading when compared to paper silver derivatives.

On a side note, silver in the form of jewelry commands premiums of 800% + over spot prices. This is very high compared to bullion prices which, in the case of coins – such as Perth Mint coins - can also be of very high quality and finishing.

- I found other sources of silver bullion on the Internet in a foreign country at lower prices, can you match the price?

-

We offer competitive discounts through our Discount Tiers.

When comparing prices with other online bullion dealers outside of Malaysia, check whether they will ship internationally. Many bullion dealers in the U.S.A. do not ship internationally due to insurance and customs regulations that differ for every country.

Next, check if your order is fully insured. Insurance is a large component of the shipping cost and normally requires a third party insurance as courier services (including FedEx and UPS) will insure only a small portion of the order. Without insurance, should the order be lost in transit, it would be very difficult to make a claim in the country of origin.

If a dealer does ship internationally you would need to add the following costs to your order:

• Shipping and insurance Courier services will charge a shipping fee for delivery but will not insure high value goods such as Silver Bullion. Third Party insurance will normally represents an additional 2% to 3 % of shipment value for Silver (Gold is below 1%).

• SST (tax) depending on jurisdiction, the shipper, not the seller, (eg: FedEx) will pay customs duty (if applicable) of the shipment value on your behalf to get the silver cleared through customs. You will receive a invoice from the shipper for the SST plus a service fee for forwarding the money.

• Other fees, such as currency conversion fees from MYR to USD and wire transfer fees normally add another 1 percent or more as the bank will normally give you an exchange rate significantly below spot market rates.

• Prepayment Risk. Unlike our COD option which allows you to take delivery at the moment you pay, you almost always have to prepay, and ultimately carry a failed delivery risk, when ordering from abroad.

The total cost of the above is what you actually buy silver at. Please consider this in order to make a fair price comparison. Prices on the Silver Bullion website already include all of the above and we publish silver inventory that is in stock here in Malaysia.

- Why do prices change for bullion products I am about to purchase, in the shopping cart page?

-

Prices will continue to change until you lock in a price by clicking on the button 'Submit Order' on the summary page. Please refer to our Policies page for more details about price confirmation and the ordering process.

- Discount Tier Program

-

- What is the Discount Tier program?

-

Discount tiers are volume discounts, with a twist. The twist is that we combined the boz (bullion ounce count) of your past purchases to your current order to determine your discounted Tier price.

- What are the benefits of the Discount Tier Program?

-

-

Many existing customers qualify for immediate discounts. Log onto the website for automatic lower prices according to your discount tier.

-

Volume discounts grow from one order to the next. Even small orders can qualify for volume discounts. Great for customer who wish to dollar average through regular buying.

-

Mix and match products. This is possible as discount tiers are based on bullion ounces purchased (1 boz = 1 silver oz), which is a common measure across all products and order types.

-

- How does the discount tier program work?

-

• Add items to the shopping cart, as the shopping cart reaches a discount tier threshold (for eg: 600 boz) the appropriate discounts will automatically be applied.

• Log onto the system to have your accumulate boz count combined together with the boz of the items in your shoppping cart as below

The Discount Tier Thresholds:

The system assigns a discount tier based on the ounces (boz) in the shopping cart and the past order [requires login] ounces (boz) according to the following tables:

Each Purchased oz Counts as:

1 Silver oz = 1 boz

1 Gold oz = 25 boz

1 Platinum oz = 10 boz

To Determine Your Tier:

Tier 1 - 0 to 599 boz

Tier 2 - 600 to 1,199 boz

Tier 3 - 1,200 to 1,999 boz

Tier 4 - 2,000 to 4,999 boz

Tier 5 - 5,000 to ++

- How is the "Accumulated Bullion Discount" different from regular volume discounts?

-

A traditional volume discount applies to a single product type in a single transaction, hence only large orders enjoy volume discounts. Silver Bullion's accumulated bullion discount applies across product types across your transactions. This is true regardless of order type, so you can keep accumulating boz regardless if you are storing through S.T.A.R. Storage or buying and taking delivery of your bullion.

- I bought bullion from you back in 2015, is this still counted?

-

Yes. Your boz do not expire, we offer discount as long as you keep using the same account to submit orders.

- What purchases count toward my "boz" count?

-

The orders must have a process status of "Waiting for Payment'", "Payment Received" or "Completed".

- How would gold be counted in boz?

-

As per our own policy, gold is equivalent to 25 boz per ounce that is purchased. For example, two ounces of gold is equivalent to 50 boz.

For a given purchase and due to the current price ratio of silver to gold, silver will result in more boz, which reflects our focus on silver. This means you go up the tier faster if you first order silver and reach the higher tiers.

- How can I see my past orders and check my boz (bullion ounces)?

-

After you log into the website click on "Order History" within the "Discount Tier" box on the right column of the webpage. Your detailed order information will be listed, including your bullion ounces and order status.

I have a 300 boz balance from past orders. I am now making a 300 oz order. A 600 boz balance qualifies for a discount. Would I receive the discount on this 300 oz order?

Yes. As soon as items are added to the shopping cart, the additional ounces are counted towards the boz balance. Prices are automatically adjusted and discounts applied. Please note that discounts do not apply to past orders (ie: there is no retroactive discount applied to your past 300 oz order)

- Shipping

-

- How do you ship orders?

-

Orders are shipped in inconspicuous packaging via local courier service provider.

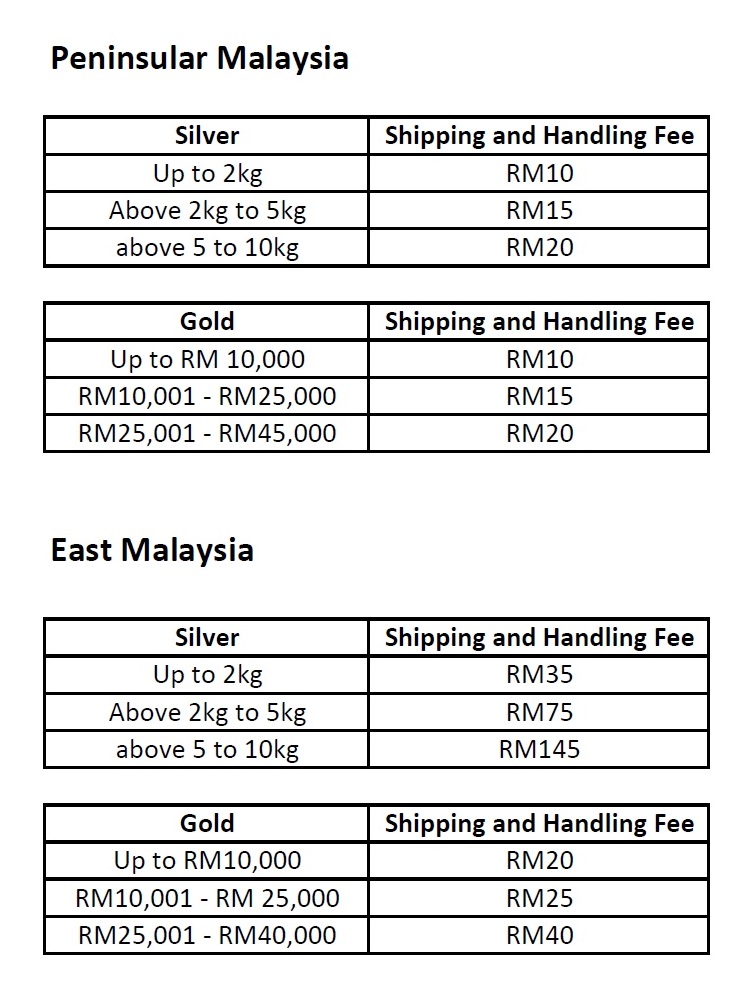

- How much is the shipping cost?

-

Q: What happens if I purchase both gold and silver in the same order?

A: The shipping and handling fees will follow whichever is higher. For an example, an order consisting of 2.5kg of silver and 10g of gold will be charged RM 15 for the shipping and handling fees.

Q: What is the maximum amount you can ship in one parcel?

A: For silver, we will ship a maximum of 10kg per parcel and anything exceeding 10kg will be shipped in a separate parcel. As for gold for West Malaysia clients, we will ship out a maximum value of RM 45,000 per parcel and RM 40,000 per parcel for East Malaysia clients. This is done to ensure the insurance coverage limit is not exceeded per parcel.

Q: What does the Shipping and Handling fee cover?

A: It covers the total cost of packaging, delivery fees and insurance coverage for each parcel.

- Will I be given a tracking number to track my parcel?

-

Yes.The tracking number for your parcel can be seen in your e-mailed invoice.

- What happens if my order is lost in transit?

-

In the unlikely event your order is lost in transit, please contact us immediately so we can begin the claims process.

- Do you ship internationally ?

-

Yes we do. We ship via FedEx and all shipments are fully insured.

Please e-mail us to get a shipping quote before placing an order.

- Will I have to pay duties or taxes when I receive my order?

-

You may be subject to taxes and/or duties for your order. All duties and taxes must be paid by the customer on delivery. Please consult your local customs broker for more information on duty and tax rates.

- Can I purchase silver while being outside of Malaysia and pick it up at a later date?

-

Yes. You can lock in a price and make a purchase from anywhere.

If you choose to do this, we require full payment to be initiated within one business day of placing your order. We will hold the physical bullion for you until you pick it up. Please note that we require a pickup in Malaysia within one (1) month of pickup notification as notified to you via e-mail and/or secure notification, failing which, the pickup order will either be cancelled or Bullion shall be transferred into storage and storage fees will start to accrue in accordance with the prevailing storage rates.

- Does Silver Bullion Sdn Bhd declare the value of the package on Customs Forms?

-

We always declare the full value of the shipment on any customs form. There are no exceptions to this rule.

- Selling Your Bullion To Us / Our Buyback Program

-

- How does your buyback program work?

-

Silver Bullion Sdn Bhd is always interested to buy investment grade (.999 or higher) silver or gold bullion. We buy the type of major brand bullion we stock in inventory regardless of provenance at very competitive rates if the specific bullion was originally bought from us (the “From Client” price).

For bullion of the same type we sell, but not bought from us, we offer to purchase at "Non-client price" which can be below spot but is still much higher than most gold or silver "buyback programs".

To find out how much are our current buy back prices, please click on this link.

- How do you buyback the bullion in your office?

-

The step by step process:

1. Submit a sell order using this link and you will receive a Purchase Order (PO) number once completed. The prices in which were submitted are valid up to 1 business day meaning if a sell order was submitted today, you are required to bring your bullion latest the next day in order for the price to be valid.

2. Buyback occurs at any one of our Silver Bullion offices at Kuala Lumpur, Johor Bahru or Penang and appointment MUST be made before coming. Once the bullion has been authenticated, we will proceed in payment either via cash or instant bank transfer.

3. A photocopy of your identification card (IC) or passport and contact information is required. If available, please bring along the original invoice of the bullion.

Please read our policies and procedures, under the section for Buybacks.

- What happens if many customers were to sell bullion at the same time? Can you fulfill the buyback requests?

-

Our goal is to maximize investment grade, silver bullion holdings. This happens when we make a direct purchase from you which is typically a rate below acquisition prices. This makes the buyback option attractive to us.

For more information, please read clause 9.5 under the Buyback option section.

- Buying and selling spreads seem high for physical compared to paper silver. Why?

-

There is a saying in the precious metals industry: “If you cannot touch it you do not really own it”. Paper silver is a derivative of physical silver bullion. In most cases these derivatives are secured through other derivatives which in turn are backed by only a tiny fraction in physical bullion reserves. Normally, there is no practical way to convert the paper silver to physical bullion. This means that you do not own the bullion, you only purchase price exposure.

The lack of physical backing means that it is possible to create nearly unlimited amounts of paper silver at virtually no cost. Furthermore, only a small fraction of deposited money is needed by the issuing institution to hedge their position through other financial instruments such as Comex futures contracts.

Hence these paper silver products can be very profitable for the issuer even with low buy / sell spreads as there is almost no cost involved in creating paper silver positions. As a consequence at the Comex futures exchange – which is often used to back silver derivatives and the guarantor of last resort – the ratio of physical silver reserves to paper positions is well below 10%. So there are at least 10 claims on the same silver and this ratio is likely to shrink further as more silver derivatives are opened.

Physical silver bullion means that you take possession of the actual metal and you own 100% of the bullion (measured in troy ounces).

Many of our customers purchase physical bullion as a long term means to profit from the ongoing decline of confidence in the US dollar, given the vast amounts of debt that was accumulated over the last 30 years and the more recent explosion of currency (base money, or euphemistically called "quantitative easing") across the world.

Given this context the demand for physical bullion comes from the simple fact that physical bullion, unlike bullion derivatives, cannot be created out of thin air. By owning the actual metal you can make sure that there are no multiple parties with claims on the same bullion and your position cannot be frozen or closed as it could with a financial derivative.

Thus:

To actively trade on silver, a paper silver derivative that obtains price exposure will likely be a better choice as transaction costs are lower and there is no tax involved.

On the other hand, for a solid long term protection against currency crises, high inflation and a potential systemic financial collapse, the simplicity and 100% ownership of physical bullion are compelling arguments.

- When will I receive the proceeds from a sale?

-

Payment will be immediate via instant bank transfer or cash, whichever that is available at the time.

- Can I request my proceeds to be paid out in currencies other than MYR?

-

Proceeds will only be paid out in Malaysian Ringgit (MYR).